Picture this: as the committee member, you reduce your society’s electricity bills to 0. It may sound unbelievable, but it’s not impossible. All you have to do is transition to a cleaner, more sustainable source for your society’s energy needs.

Many housing societies, like yours, often grapple with exorbitant power costs that increase maintenance bills, thus distressing residents. But here’s some exciting news: housing societies are taking a bold step by switching to solar energy, and the results are astounding!

With government subsidies like PM Surya Ghar Muft Bijli Yojana, adopting solar is becoming a lucrative and smart choice. Thus, housing societies can upgrade their energy requirements while contributing to a greener future.

If you are a committee or RWA member and you’re thinking about going solar, this article covers–

- A few essential factors to consider before your society goes solar

- The approximate cost of solar for an RWA or Management Committee

- The available financing options

- How you can choose the best solar solution with the right solar vendor for your housing society

The Price of Solar For Housing Societies: Factors to Consider

1. Electricity Consumption

Evaluating the society’s electricity consumption determines the feasibility and size of the solar system required. Collect electricity bills from the past year to analyse energy demand peaks and how much could be offset by solar energy.

For example, if your average electricity consumption for the year is 1,40,000 units, the solar system size you would require–

1 kW solar = ~1400 units

Solar system size = electricity consumption/units generated per kW

= 1,40,000/1,400

= 100 kW

2. Open Roof Space

Your roof should have enough open space to accommodate the solar panels without any form of shadow falling on the panels. Ideally, the system will face south and be angled at 10° to maximise sunlight exposure. Ensure no obstructions like trees, neighbouring buildings, TV dishes, or more, cast shadows on the panels.

Typically, a 1kW solar takes approximately 80 sq. ft. of roof space. For a 100 kW solar system, you need about 8000 sq. ft.

3. Sanctioned Load

The sanctioned load is the maximum amount of electrical power that a housing society can use from the grid, as determined by the electricity board. Verify your sanctioned load and ensure that your solar panel installation’s size does not exceed this approved limit.

If your intended solar panel installation exceeds the sanctioned load, consider requesting an increase from the electricity board.

The Price Range of a Solar System for Housing Societies

The cost of a solar system depends on the capacity required to meet your society’s energy needs. It also varies based on the type and brand of solar panels chosen. However, one thing remains consistent: the subsidy across India is set at ₹18,000 per kW (up to ₹90 Lac).

Let’s look at an example to understand the costs better:

Project Capacity (DC): 100 kW

Number of Panels Required: 185*

Cost per kW: ₹45,000 – ₹65,000

*For a 100 kW system using Mono-PERC bifacial solar panels: (100 kW / 0.54 (the wattage capacity per module for MonoPERC half-cut bifacial panels))

Project Cost (Without Subsidy):

Calculating at an average of ₹60,000 per kW:

100 kW * ₹60,000 = ₹60,00,000

Subsidy:

₹18,000 per kW * 100 kW = ₹18,00,000

Total Project Cost (After Subsidy):

₹60,00,000 – ₹18,00,000 = ₹42,00,000

This is a rough estimate to help you understand what to expect when planning your society’s switch to solar.

The final price may vary depending on the panel brand/type and other variables chosen, but the savings and environmental benefits are clear!

Financing Options for Housing Societies

Financing can often be a major concern for housing societies for multiple reasons. Fortunately, several flexible and affordable finance options are available to help make the switch to solar more accessible without straining the Society’s budgets.

1. Through Corpus

If the society has a healthy reserve, it can dedicate a portion of the amount to the solar initiative, eliminating the necessity for outside loans. The decrease in electricity costs will help restore the fund over time. With strategic budgeting and careful resource allocation, society can still address maintenance and emergency needs without exhausting its reserve funds.

2. Through OD Facility from the Bank

The OD facility is a great option if the society has a good relationship with the bank and can offer an overdraft loan at a lower interest rate. Typically, banks require a strong credit history, financial documents, and a viable project proposal. The society will need to discuss terms such as the overdraft limit and interest rates with the bank.

3. OPEX Financing

This financing type is a way to access solar energy without a large upfront investment. Your choicest solar vendor will design, construct, engineer, procure, monitor, maintain and own the solar system on your roof.

It also involves signing a Power Purchase Agreement (PPA) where you will pay a monthly electricity bill to the solar system vendor, which is often cheaper than the regular DISCOM rates per unit.

4. Through 0 Investment Plan with SolarSquare

When you choose to go solar with SolarSquare, our Zero Investment Plan makes the process simple and affordable.

Here’s how it works:

- Zero Initial Investment: The down payment you pay is reimbursed through the government subsidy, so you start with no out-of-pocket costs.

- Easy EMIs: Your monthly EMIs are designed to match your electricity bill savings, so you’re essentially paying nothing extra.

- Flexible Payment Terms: We offer flexible EMI options from 6 to 60 months, allowing you to pick a plan that fits your budget.

With our plan, you’ll see savings from day one, making your solar investment practically cost-free. It’s the smart, hassle-free way to go solar!

Choosing the Right Solar for Your Housing Society

When choosing a solar provider for your housing society, evaluate these factors for a smooth installation process and long-term satisfaction.

1. Gauge Their Expertise

- Visit the company’s previous installations

Visit the locations where the company has already set up solar systems, ideally those comparable in size to your housing society. How are the installations performing? What is their overall condition, and how do they fit into the existing setup?

Talk with residents or management to gather direct insights about their experiences.

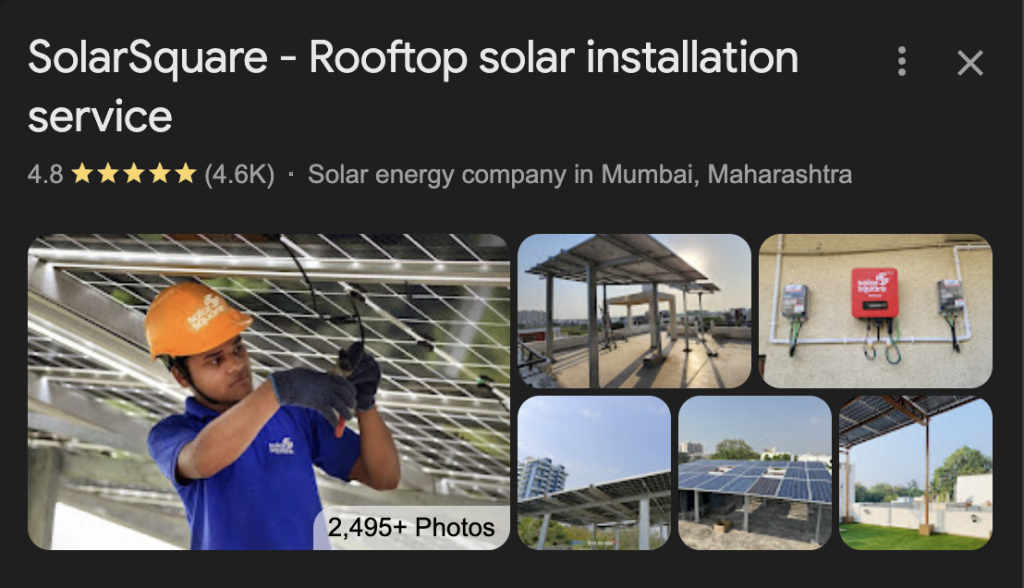

- Check Google ratings and customer reviews

Check out reviews on Google, social media, and various review sites to assess customers’ satisfaction. Ask the company for testimonials or case studies highlighting successful projects and feedback from those society members.

- Assess their experience in handling housing society projects

How many housing society projects has the company successfully finished? Assess the technical qualifications of their team—look for relevant certifications, training, and proficiency in managing intricate installations.

2. Seek a Solar Partner with the right After-Sales/Maintenance capabilities

Regular maintenance keeps your housing society’s solar system running smoothly and maximises its lifespan. Just like your cars and AC units need routine servicing to avoid costly repairs, your solar system requires the same level of attention.

Without proper upkeep, you risk facing unexpected breakdowns, reduced efficiency, and significant drops in energy production—issues that can disrupt the entire society and lead to higher expenses.

To protect your investment, choose a vendor that provides prompt support to quickly address any problems, minimise downtime, and ensure continuous energy generation.

Look for:

- Comprehensive coverage: The maintenance service must include regular inspections, cleaning, repairs, and monitoring of system performance

- Response time: Confirm that the service agreement outlines the expected response times for resolving problems.

- Warranty and guarantees: Review the warranty conditions related to the solar panels and the quality of installation work.

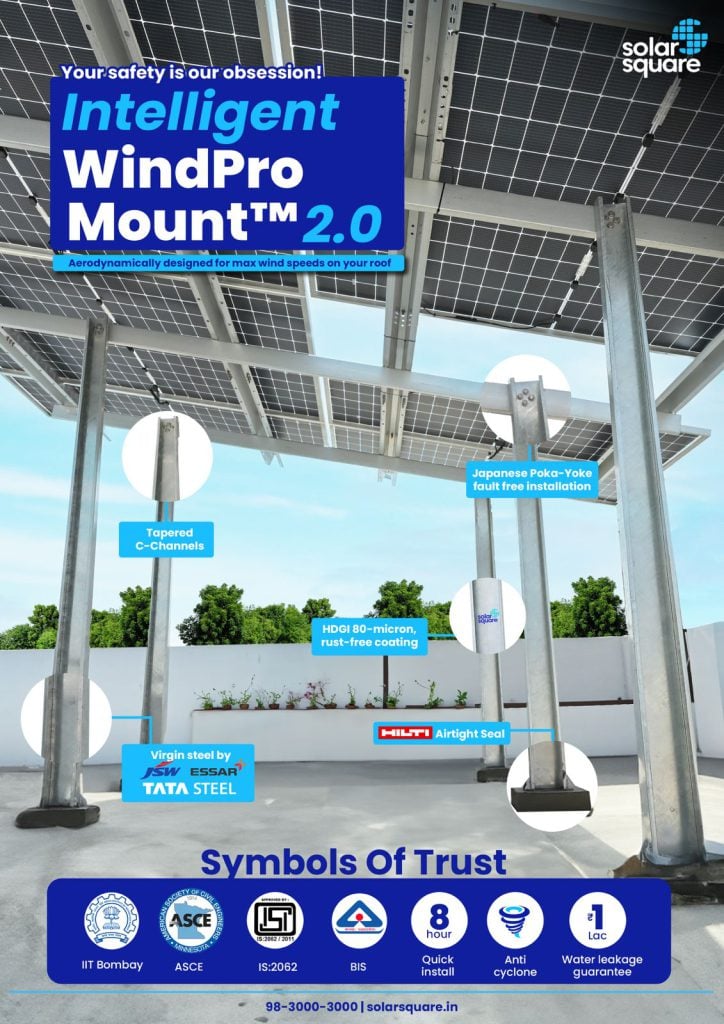

3. Ensure Their Structures are Cyclone-proof

Are the mounting systems engineered to endure severe weather events like strong winds, intense rainfall, and storms? Are the components corrosion-resistant and durable to ensure longevity? Verify that the structures comply with applicable national and international safety and durability standards.

Here’s an example of a solar installation not built to withstand severe weather.

4. Check the Solar Partner’s Financial Strength and Payment Terms

Check the company’s financial health to ensure it can complete the project and provide ongoing support. Seek stability indicators, like a solid track record in the industry and positive feedback from suppliers and clients.

Make sure to outline the payment terms clearly – initial payments, milestones, and final settlement. Check if the company offers flexible payment options, such as financing plans or phased payments based on project completion.

5. Ask for a Detailed Quotation

Key elements that should be included in a quotation from the ideal solar vendor include–

- System design: Comprehensive design details, specifying the quantity and kind of panels, inverters, and other necessary elements.

- Cost breakdown: A clear breakdown of solar panel installation costs, including equipment, installation, maintenance, and additional fees.

- Timeline: A timeline outlining the entire project duration from installation to commissioning.

- Warranties and guarantees: Details of warranties for the panels, inverters, and installation workmanship.

Get multiple quotations and compare them based on the cost of solar panel installation, quality, services offered, and terms. Consider the overall value rather than just the lowest price. The cheapest option may not always provide the best long-term value.

Switch to SolarSquare – The Best Solar System for Housing Societies

SolarSquare is India’s #1 home solar company and the premier choice for housing societies looking to go solar. Here’s why.

- SolarSquare boasts an impressive rating of over 4.8 stars on Google with over 4,500 reviews, reflecting high customer satisfaction and trust. We are India’s only solar brand with the highest number of reviews.

- With over a decade of experience, we have completed numerous solar projects for housing societies, demonstrating their expertise and reliability.

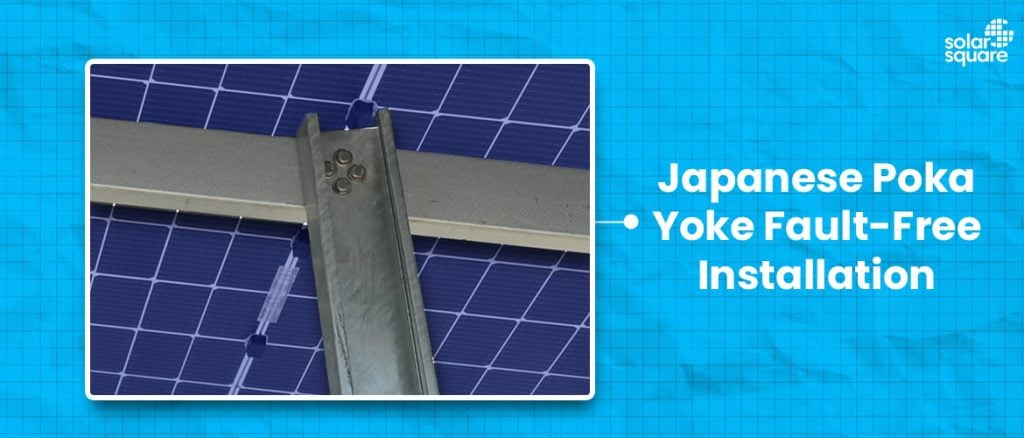

- Thanks to the Japanese Poka-Yoke techniques, SolarSquare guarantees a seamless installation experience, minimising the likelihood of human error.

- We take pride in using top-notch pre-fabricated structures from premium virgin steel sourced from industry leaders.

- Each installation is treated with a rust-resistant coating, ensuring they are built for longevity. Additionally, to secure a leakage-free roof, we apply a HILTI AirTight waterproofing solution before installing our structures. If there is leakage despite our chemical anchoring, we assure Rs 1 lakh refund in case of water damage.

- Our Intelligent WindPro Mount is trademarked and designed to withstand cyclones and extreme weather conditions. Thus our structures can endure wind speeds of up to 180 km/h and have been certified by IIT Bombay as cyclone-proof, offering unbeatable safety and durability.

- With a strong commitment to excellence and customer satisfaction, we back our products with an impressive 5-year warranty.

- We also offer a range of financing options, including 0% interest EMI plans, making it easier for housing societies to afford solar installations without significant upfront costs.

- We offer 360-degree maintenance, including deep cleaning of solar panels and comprehensive checks to ensure your system is running smoothly. Powered by the best and latest software technology, we remotely track your solar system’s performance and alert you if there are any problems with your system.

Make the switch towards sahi maintained solar with SolarSquare – contact us today.

FAQs

Q1. When will the housing society get the solar subsidy?

Ans. The timeline for receiving this subsidy varies, depending on the approval process by the government authorities and their disbursal cycle. You can check the subsidy status through the national portal for rooftop solar.

Q2. How can the housing society apply for solar financing with SolarSquare?

Ans.

The eligibility criteria for SolarSquare financing include the following:

| Profitability of the Society | Revenue should be positive |

| Maintenance Collection | 90% must be collected on Time |

| Capital + Reserves | Must be 10% of Loan Value |

| Power Bill Repayments | No dues |

| Right to Roof | To be present for solar installation. |

| Provision of borrowing in bye-laws | Should be available |

| Duration of present Society’s management committee and next election date | Minimum till loan tenure. |

| Any existing major loan from the Bank | Yes/No |

Documents required include the following:

- PAN CARD of society – Self-attested

- KYC of signing authority (Any 2 Members) – Self-attested

- Registration documents – Self-attested

- List of members – Self-attested

- Contact details of signing authority

- Last 12 months’ bank statement

- The last 3 months’ electricity bill

- The last 2 years audited financials

- Quotation

Loan approvals are fast, often within 2-3 days. EMIs commence after the loan is approved.

Q3. When will the breakeven point happen for housing societies?

Ans. The breakeven point for housing societies investing in solar energy depends on the price per unit charged by the electricity board.

Formula:

Breakeven Point (years) = Net Cost of Solar Project/Annual Savings

Where:

- Net Cost of Solar Project = The total cost after subsidy.

- Annual Savings = Annual Energy Production (in units) × Rate per Unit of Electricity

Example Calculation:

For a 100 kW system with an average cost of ₹60,000 per kW:

- Net Cost of Solar Project = ₹60,00,000 – ₹18,00,000 = ₹42,00,000

- Rate per Unit of Electricity = ₹10 per unit

- Annual Energy Production = (from the previous example, 100 kW system) ≈100×1400=1,40,000 units/year

Steps:

- Calculate Annual Savings:

Annual Savings = 1,40,000×10 = ₹14,00,000 - Calculate Breakeven Point:

Breakeven Point (years) = 60,00,000 / 14,00,000 ≈ 4.2 years

This means the housing society would recover the solar installation cost in about 4.2 years from saving on electricity bills.

Q4. What is the maximum subsidy a housing society can avail itself of through PM Surya Ghar Muft Bijli Yojana?

Ans. Housing societies can receive a government subsidy of ₹18,000 per kilowatt, up to ₹90 lakh for a maximum of 500 kilowatts.

Q5. Is solar maintenance necessary for housing societies?

Ans. Yes, solar maintenance is necessary to ensure optimal performance of the solar power systems. Over time, panels can accumulate dust, debris, bird droppings and other residues that can significantly decrease their effectiveness.

Scheduled maintenance with cleaning and inspections can prevent these issues, prolong the solar system’s lifespan, and ensure that the system continues to provide substantial energy savings for society.