Many housing societies that have gone solar have realised that installing a solar system is not just a smart financial decision; it’s a significant step toward sustainability. By harnessing solar energy, these housing societies have drastically reduced their electricity costs while contributing to a greener environment.

A prime example is Maurishka Palace in Mangalore, a housing society that saved an impressive ₹53 lakhs on electricity bills in under four years after installing SolarSquare’s solar system. This remarkable case study is a testament to the tangible impact of solar energy on reducing costs and underscores the value of making this investment.

To make this transition even more accessible, PM Surya Ghar Muft Bijli Yojana offers generous subsidies for solar installations for housing societies. However, to avail of these subsidies, or to secure financing through a lending institution, housing societies must provide the right documentation.

This guide outlines the necessary paperwork and eligibility criteria to ensure a smooth and successful solar installation for your housing society.

Documents Required to Avail Solar Subsidy for Housing Societies

- Latest Paid Electricity Bill: To verify the electricity connection and consumption.

- Copy of Aadhaar Card (Authorised Person): The Aadhaar card of the person authorised to represent the society.

- Copy of PAN Card (Authorised Person): The PAN card of the authorised person.

- Copy of the Society PAN Card: The society’s official PAN card.

- Property Paper: This can include a registry copy, 7/12 extract, Index-2, or property tax receipt to verify ownership.

- Society Registration Certificate: Proof of the society’s legal entity.

- Authorisation Letters on Society Letterhead: Letters authorising specific individuals to act on behalf of the society.

Check with your state’s energy department or the solar vendor for specific document requirements. Different states may have additional or alternative documents.

Additional documents:

- Bank account details

- No Objection Certificate (NOC) from municipal corporations

- Society bylaws

- Detailed project proposal

The Process of Applying for Subsidies for Housing Societies

To avail of the benefits of the PM Surya Ghar Muft Bijli Yojana, follow these steps.

1. Registration and Application

Access the official website of the PM Surya Ghar Muft Bijli Yojana. Provide the necessary details on the portal to create an account for your housing society.

Fill out the rooftop solar panel installation application form, specifying the desired capacity and other relevant information. Then, submit the required documents, including proof of identity, address, electricity bill, and roof ownership certificate.

2. Installation and Commissioning

Once the electricity distribution company (DISCOM) approves the feasibility of the solar installation, choose a registered solar vendor like SolarSquare to install the solar system. Apply for net metering to exchange excess electricity with the grid. Undergo a final inspection by the DISCOM to obtain a commissioning certificate.

3. Claiming the Subsidy

Submit your bank account details and a cancelled cheque using the portal. The subsidy amount will be credited to your bank account within the stipulated timeframe by the government.

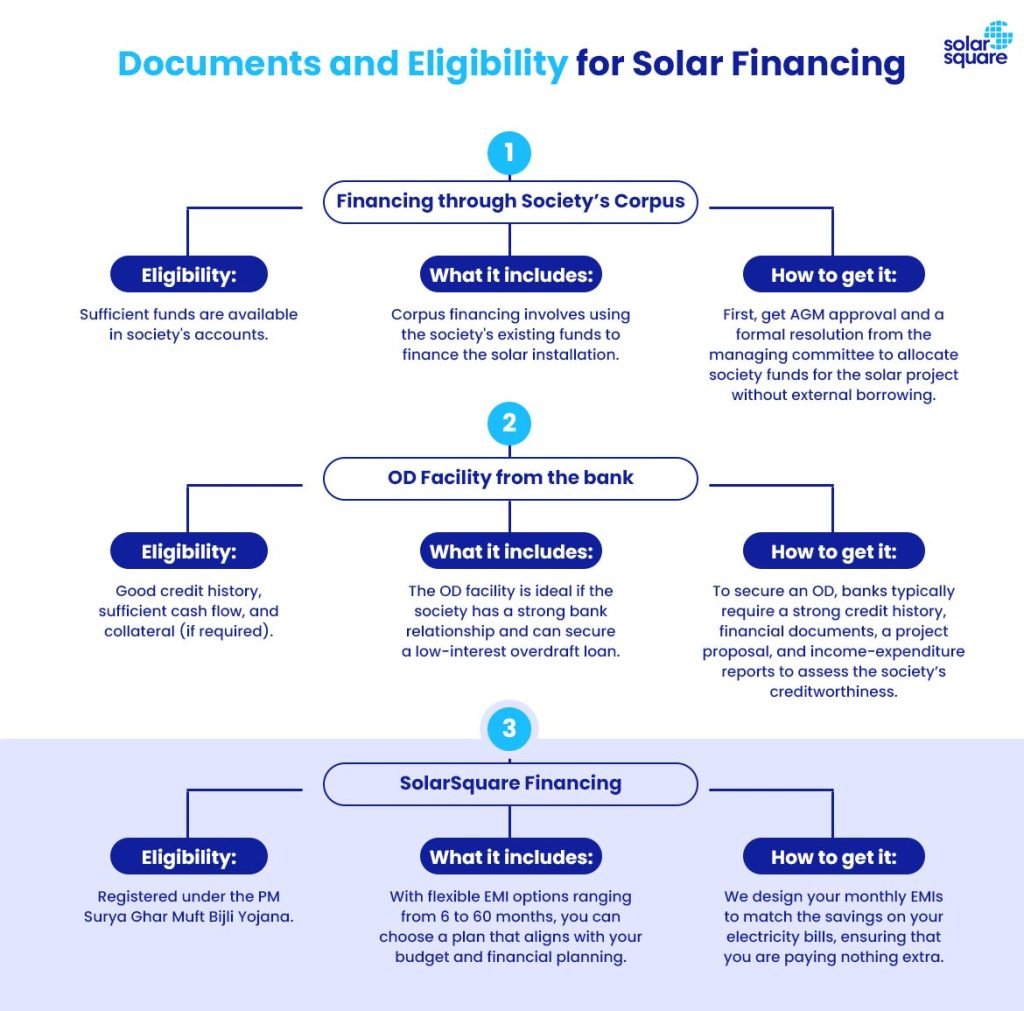

Documents and Eligibility for Solar Financing

Arranging financing for solar installation for a society is often a concern due to various factors. Fortunately, there are several flexible and affordable financing options available that make switching to solar energy more accessible without putting undue strain on the Society’s budget.

Financing through Society’s Corpus

Eligibility: Sufficient funds are available in society’s accounts.

What it includes:

Corpus financing involves using the society’s existing funds to finance the solar installation. This could include money from the society’s reserves, sinking funds, or other pooled resources.

How to get it:

The first step is to obtain approval from the society’s members during the AGM (Annual General Meeting). The managing committee must pass a formal resolution authorising the use of society funds for the solar project. Once approved, funds can be allocated from the society’s reserves or sinking fund, ensuring the project is financially supported without external borrowing.

OD Facility from the bank

Eligibility: Good credit history, sufficient cash flow, and collateral (if required).

What it includes:

The OD facility is a great option if the society has a good relationship with the bank and can offer an overdraft loan at a lower interest rate.

How to get it:

Typically, banks require a strong credit history, financial documents, a viable project proposal, and society’s income-expenditure report to assess the economic health and creditworthiness of the society. The society will need to discuss terms such as the overdraft limit and interest rates with the bank.

SolarSquare Financing

Eligibility: Meet basic eligibility criteria set by SolarSquare and be registered under PM Surya Ghar Muft Bijli Yojana.

What it includes:

When you opt for SolarSquare, our Zero Investment Plan makes the process simple and affordable. With flexible EMI options ranging from 6 to 60 months, you can choose a plan that aligns with your budget and financial planning.

How to get it:

In SolarSquare, your initial down payment is reimbursed through the government subsidy, meaning you start with zero out-of-pocket costs. We design your monthly EMIs to match the savings on your electricity bills, ensuring that you are paying nothing extra. Your electricity bill savings offset the EMI payments for a seamless transition.

Before choosing the right financing option, you must get approval from your housing society’s Annual General Meeting (AGM) for installing solar.

Once you have a reasonable estimate of the level of support from the members, here’s how you can manage achieving the necessary approvals effectively.

Tips to Achieve Approval from the AGM to Install Solar

1. Secure Approval from the AGM

Before the AGM, gauge members’ interest in a solar project to build support. Present a clear proposal at the meeting, detailing costs, benefits, and environmental impact. Address potential objections and highlight long-term gains to gain approval.

2. Form a Solar Committee

Create a committee with members skilled in finance, engineering, and project management. Their role includes researching solar options, liaising with vendors, managing the budget, and overseeing the project.

3. Request Quotations (RFQ)

Issue an RFQ outlining project requirements, system size, timeline, warranty, and maintenance. Evaluate bids based on cost, vendor experience, and product quality.

4. Hire a Solar Advisor

Engage a reputable solar advisor, such as those from SolarSquare, to ensure proper design and implementation. They will serve as liaisons and streamline decision-making.

5. Educate Society Members

Run awareness campaigns to showcase the benefits of solar energy, including cost savings and environmental impact. Use brochures, Q&As, and success stories from other societies to build enthusiasm and keep members informed.

Ready to make the switch? Choose SolarSquare

Selecting the right solar provider is key to maximising these benefits of going solar. SolarSquare stands out with its proven track record, having powered over 150 housing projects. Our expertise ensures you benefit from subsidies and enjoy reliable, high-quality installations that help you save on energy costs while making a positive environmental impact.

Make the switch towards Sahi Solar with SolarSquare – contact us today.

FAQs

Q1. How long does it take to install solar for housing societies?

Ans. Installation of solar systems for housing societies typically takes 12-20 weeks. This includes:

– Planning and approval: 2-4 weeks for site assessment and approvals.

– Installation: 4-6 weeks to fit the system.

– Inspection and commissioning: 4-6 weeks for final checks and activation.

Factors affecting the timeline:

– System size: Larger installations take longer.

– Installation complexity: Roof type and structural issues can delay progress.

– Approval delays: Waiting for permissions and inspections can add time.

– Vendor efficiency: The experience of the solar vendor impacts the timeline.

Q2. When will the housing society get the solar subsidy?

Ans. The timeline for receiving this subsidy varies, depending on the approval process by the government authorities and their disbursal cycle. You can check your subsidy status through the national portal for rooftop solar.

Q3. How can the housing society apply for solar financing with SolarSquare?

Ans. The criteria to qualify and apply for solar financing with SolarSquare are as follows.

The eligibility criteria for SolarSquare financing include the following:

| Profitability of the Society | Revenue should be positive |

| Maintenance Collection | 90% must be collected on Time |

| Capital + Reserves | Must be 10% of Loan Value |

| Power Bill Repayments | No dues |

| Right to Roof | To be present for solar installation. |

| Provision of borrowing in bye-laws | Should be available |

| Duration of present Society’s management committee and next election date | Minimum till loan tenure. |

| Any existing major loan from the Bank | Yes/No |

Documents required include the following:

- PAN CARD of society – Self attested

- KYC of signing authority ( Any 2 Member) – Self attested

- Registration documents – Self-attested

- List of members – Self-attested

- Contact details of signing authority

- Last 12 months’ bank statement

- The last 3 months’ electricity bill

- Last 2 years audited financials

- Quotation

Loan approvals are fast, often within 2-3 days. EMIs commence after the loan is approved.

Q4. When will the breakeven point reach for housing societies?

Ans. The breakeven point for housing societies investing in solar energy depends on the price per unit charged by the electricity board.

Formula:

Breakeven Point (years) = Net Cost of Solar Project/Annual Savings

Where:

- Net Cost of Solar Project = The total cost after subsidy.

- Annual Savings = Annual Energy Production (in units) × Rate per Unit of Electricity

Example Calculation:

For a 100 kW system with an average cost of ₹60,000 per kW:

- Net Cost of Solar Project (cost – subsidy) = ₹60,00,000 – ₹18,00,000 = ₹42,00,000

- Rate per Unit of Electricity = ₹10 per unit

- Annual Energy Production = (from the previous example, 100 kW system) ≈100×1400=1,40,000 units/year

Steps:

- Calculate Annual Savings:

Annual Savings = 1,40,000×10 = ₹14,00,000 - Calculate Breakeven Point:

Breakeven Point (years) = 60,00,000 / 14,00,000 ≈ 4.2 years

This means the housing society would recover the solar installation cost in about 4.2 years from saving on electricity bills.

Q5. What is the maximum subsidy a housing society can avail through PM Surya Ghar Muft Bijli Yojana?

Ans. Housing societies can receive a government subsidy of ₹18,000 per kilowatt, up to ₹90 lakh for a maximum of 500 kilowatts, under the National portal for rooftop solar subsidy.

Q6. Is solar maintenance necessary for housing societies?

Ans. Yes, regular solar maintenance is crucial for optimal performance. Panels can collect dust, debris, and other residues that reduce efficiency.

For example, at Prestige South Ridge in Bangalore, our ongoing maintenance of their 268 kW solar system has consistently exceeded generation targets, resulting in a 10% increase in savings for residents.

Scheduled maintenance, including cleaning and inspections, prevents performance issues, extends the system’s lifespan, and ensures continued energy savings.